FFY 2024 IPPS Proposed Rule: Wage Index

On April 10, the Centers for Medicare & Medicaid Services (CMS) published the FFY 2024 IPPS Proposed Rule (effective for discharges on or after October 1, 2023).” Toyon is pleased to provide our summary of Section 6: FFY 2024 IPPS Proposed Rule: Wage Index.

Based on the CMS proposed rates for FFY 2024, the occupational-mix adjusted national average hourly wage is estimated to be $50.27, representing an increase of 5.32% from the prior year (in comparison to a 2.86% increase in FFY 2023), which is based on wage data from FFY 2020 cost reports.

Rural Floor Wage Index Calculation Revisited

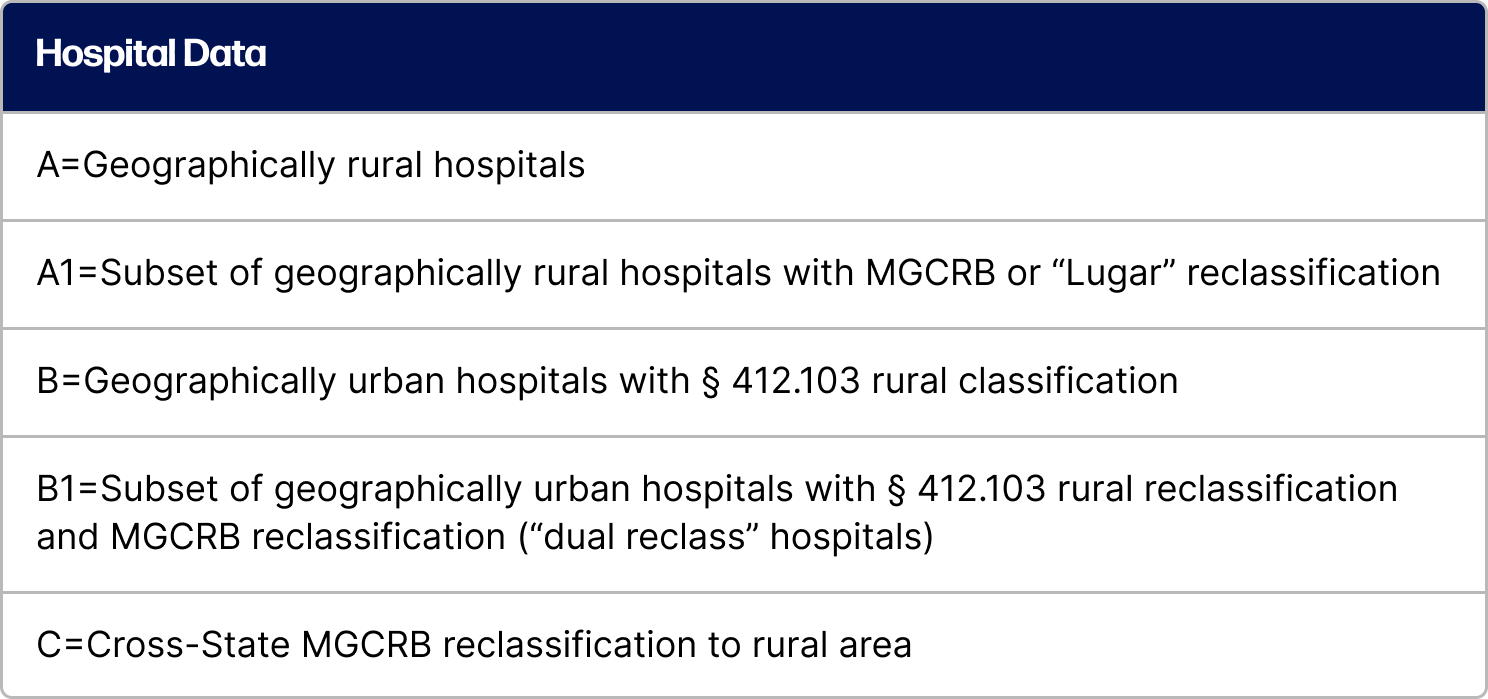

CMS is proposing to include all urban-to-rural reclassified hospitals (under 42 CFR §412.103) when determining a state’s rural floor wage index7. Rural reclassified hospitals are considered in the rural floor determination, regardless of their MGCRB reclassification status, only if it results in a higher rural wage index per CMS’s “hold harmless” provision, which is only applicable to rural areas. The following chart, provided by CMS in the Proposed Rule, summarizes the current “hold harmless” policy and proposed rural wage index calculation using the highest of these calculations in accordance with the “hold harmless” policy:

Continuation of Prior Year Wage Index Policy Changes

In FFY 2024, CMS proposes to continue increasing wage indices for hospitals below the 25th wage index percentile (or a WIF of 0.8615). In FFY 2020, CMS anticipated it would continue this policy for at least four years, acknowledging that providers in these lower-quartile areas would improve employee compensation within four years (as a result of the higher wage index). However, despite the four years as well as recent litigation where a district court ruled in the provider’s favor (Bridgeport Hospital, et al., v. Becerra), which CMS has appealed, CMS is proposing to continue this policy in FFY 2024. CMS acknowledges that it only has one year of relevant data (from FFY 2020) that it could use to evaluate the impact of this policy on wages, and thereby, CMS is proposing to continue this policy until it is able to obtain sufficient data to evaluate the low wage index policy. Consistent with the finalized policy in previous years, in FFY 2024 CMS will “fund” this policy by applying a uniform budget neutrality adjustment.

Permanent Cap Policy for Wage Index

Consistent with the policy finalized in FFY 2023, CMS applies a cap of 5% on the decrease of any hospital’s wage index from the prior year. Therefore, in FFY 2024, no hospital can receive a wage index less than 5% less as compared to FFY 2023.

Please refer to CMS Table 2 of current and prior WIFs, including application of the bottom-quartile wage index adjustment and 5% cap policy. CMS Table 2 is here on CMS website under file “Proposed Rule Tables 2, 3 and 4A and 4B (Wage Index Tables).”

Toyon’s Take:

CMS’s consideration of all urban-to-rural reclassified hospitals in the rural wage index is a notable change to how the rural floor is determined and will likely result in providers re-evaluating rural status under 42 CFR §412.103 and existing reclassification opportunities. The 5% cap on wage index decreases is favorable to providers, particularly given the impacts of the COVID-19 PHE and it remains to be seen how that will impact labor rates and the wage index on a prospective basis. Toyon is currently modeling the financial impact of the inclusion of urban-to-rural reclassified hospitals in the rural wage indices. Please feel free to contact Toyon for an estimated impact to your state(‘s) rural wage index.

Important Dates regarding Wage Index

CMS publishes various dates that correspond to wage index geographic reclassification deadlines for FFY 2024 rulemaking. Refer to the CMS website here for key dates.

For additional information, please contact Ryan Sader at ryan.sader@toyonassociates.com.

7Additional background – In FFY 2023 CMS reverted to prior policy (from FFY 2019) linking the statewide rural floor with the rural wage index, including urban-to-rural reclassifications that otherwise did not have a MGCRB reclassification (“dual status”). The change in policy in FFY 2023 was a result of public comments and a recent court case (Citrus HMA, LLC, d/b/a Seven Rivers Regional Medical Center v. Becerra) where the court found that CMS did not have the authority to establish a rural floor lower than the rural wage index for a state. The key difference between FFY 2023 and the proposed FFY 2024 calculation is the inclusion of all 42 CFR §412.103 providers (including those with an MGCRB reclassification) in the determination of the rural floor wage index.

Comments are due to CMS by Friday, June 9 via https://www.regulations.gov/ (see instructions under the “submit a comment” tab and reference file code “CMS-1785-P”). Toyon will share our comment letter in the coming weeks.